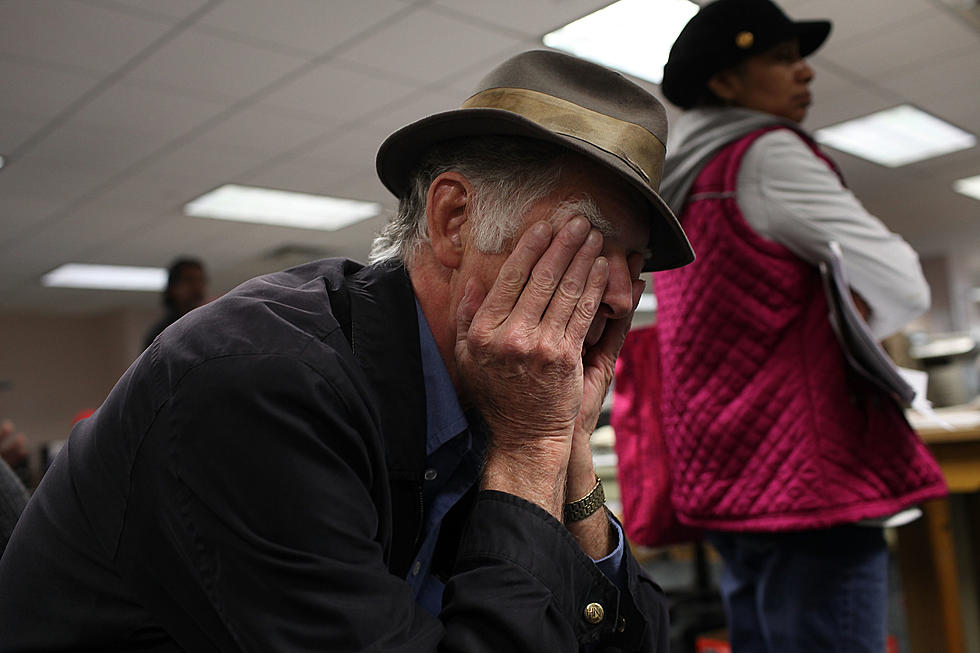

Beware! New York Unemployment Fraud, Did You Get A Tax Bill That Isn’t Yours?

Many New Yorkers are receiving tax bills from the IRS as well as the State for unemployment benefits that they did not file. This is unemployment identity fraud and if you are a victim. here's what you need to do.

According to the Department of Labor, There are individuals out there that knowingly submit false unemployment information in order to collect benefits that do not belong to them. If they are using your information (stolen identity) they are drawing money under your name. Now that taxes are due you, the victim, could be on the hook for that bill.

If you have received a bill from the IRS, New York State Department of Taxation and Finance, or another state tax department related to unemployment benefits that you did not file, here is what you need to do.

IRS Bill

- Go to page 2 of the bill

- Check the “Unemployment Compensation” section to see the “Received from” and “Address.”

- If there are multiple states listed you should report fraud in each of those states.

- Request a corrected Form 1099-G

Tax Bill - 1099G - Out of State

- Determine which state is the issuer

- Immediately report the fraud to that state

- Request a corrected Form 1099-G

Tax Bill - 1099G - New York State

- File a fraud report with NYSDOL

- Answer “Yes” to the question “Did you receive a 1099-G or a message about a 1099-G from the NYSDOL or a notice from the IRS or New York State Department of Taxation (DTR-960-E) regarding benefits that you never received?”

- Once you’ve received an amended 1099-G tax form in the mail from NYSDOL, submit the amended 1099-G for review to the New York State Department of Taxation and Finance by following the instructions on the notice.

LOOK: Here is the richest town in each state

Here Are The Top 8 Insanely Rich People in New York State

These Are New York's 14 Most Expensive Colleges For 2022-2023

More From WPDH-WPDA