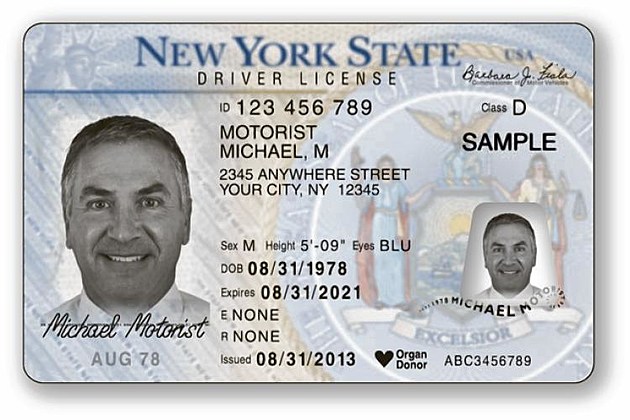

Driver’s License Required to File Taxes in NY

The change goes into effect this year.

Never before did we need our driver's license to file our tax return in New York state, but that is all going to change this year.

According to News 10, this is the first year that New Yorkers will be required to submit a copy of their driver’s license with their tax return.

CPA Matt Bryant of the New York State Society of CPAs told News 10, “The state is asking for the driver’s license information as an additional verification step, to make sure that the tax refunds go to the right people.”

Bryant also said that, “There’s a spot to enter the information, it will not print on the return you have on the copy, but it will go electronically to the government when you file your return.

Anyone who doesn't have a license can submit a state-issued ID in its place and if you don’t have a state-issued ID or driver’s license you can check the no applicable ID box in your return.

If you do check the no ID box Bryant said, “That alone will not delay your return but if the state has a problem verifying your identity, that may delay your return.”

If you are looking for more information on the changes you can check out the New York State Society of CPAs website.

More From WPDH-WPDA